The Economic Schism: We’re In a Trade Recession (Not An Actual One)

And This Trade Recession is Coming to an End

TLDR:

Atlas Analytics maintains that the U.S. is not in, or currently headed for, an overall recession, with Core GDP remaining strong.

A trade recession brought on by the Trump Tariffs has affected economic growth, but Atlas Analytics suggests this pattern may be starting to reverse.

Opportunities to “buy the dip” may be nearing a near-term end as Atlas Analytics predicts GDP for Q2 2025 to rebound and financial valuations nearly at parity with fundamental value.

This quip from James “The Ragin’ Cajun” Carville (and made famous by his candidate Bill Clinton) during the 1992 U.S. Presidential election encapsulates a central truth about the American electorate: more so than any other single issue, the state of the economy is perhaps the most important thing to the general populace.

The key question to the voters is whether there are more jobs, more financial value, and more economic growth to support a better quality of life.

Central to this is the question: “Are we in a recession?”

So I rephrase Bill’s famous line: “It’s the (trade) economy, stupid!”

As I’ve been shouting from mount high (or at least my Substack) for the past five months since Donald Trump took office that we are not in a recession.

Now, I add a corollary to my above statement. We are not in a recession, but rather we’re in a trade recession.

And this trade recession is close to ending.

The Economic Schism

In this third and final segment of our series on how Atlas Analytics’ views the economic world (see The US Economy Is Not Heading for a Recession Yet and The “Rubber Band” Theory of Finance for the first two), we describe the Economic Schism, the divide between patently positive Core GDP and starkly negative Net Exports.

Frequent readers will recall Atlas Analytics utilizes satellite imagery from outer space to measure changes in the built environment (see our article A Picture Is Worth a 1,000 Words: Measuring Core GDP from Outer Space), and then we use AI and machine learning to predict what we’ve termed Core GDP.

For new readers, Core GDP is Consumption, Government Expenditures, and Private Fixed Investment, summing to approximately ~70% of headline GDP.

Given the satellites circumnavigate Earth sub-daily, Atlas Analytics is able to provide clients with a weekly update to Core GDP (and by extension, overall GDP).

As we continued to write about last week, Core GDP is strong (remember when I said to Buy the Dip?). Hovering around the mid-3’s for the last ~two quarters, Core GDP is far from recessionary (contact us below for our proprietary client dataset).

In contrast, what is recessionary is Net Exports. As we’ve written about, the trade balance has literally fallen off the page.

Instead of an actual recession, we’ve experienced a Trump Tariff-induced trade recession. As a reminder, business front-running of the Trump Tariffs resulted in a huge jump in imports, which are a drag on GDP.

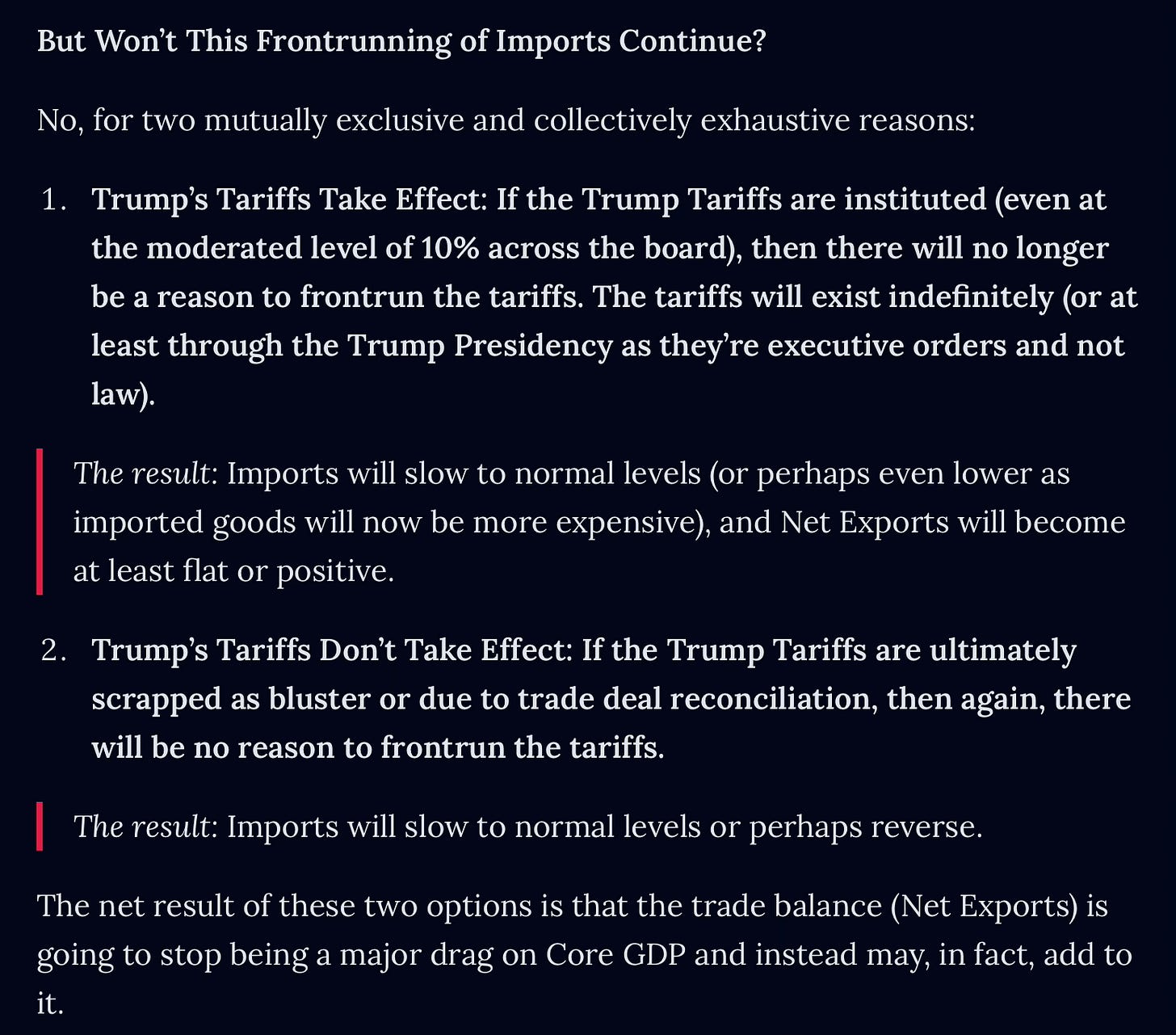

And as we wrote two weeks ago, this front running is likely to end for one of two reasons:

This means that the trade recession is nearly at its end.

But what does the most recent trade data show?

What the Data is Showing

This morning, the U.S. Census Bureau released its first look at the trade balance through April’s Advance U.S. International Trade in Goods at –$87.6 billion.

For context, last month was -$162.0 billion, meaning this month is nearly half of the level it was over the last three months.

As expected, the trade balance has begun to reverse. Of course, this is just one month, and a single reading does not constitute a pattern. Nevertheless, this is the direction we expect the trade balance to continue in.

What Does This Mean for National GDP and Your Portfolio?

Using Atlas Analytics’ model, we’ve revised our estimate for the Net Exports percentage point contribution to GDP to +3.30%.

Combined with our Core GDP (+3.33%) and Private Inventories (-0.70%), we’re predicting headline GDP (currently) at +5.93%.

What does this mean?

As we wrote to our subscribers last week, U.S. GDP is set to soar in Quarter 2.

Does this mean that you should go full-steam ahead with your long-equity positions?

Not exactly.

As we’ve been advising our clients, the financial market undervaluation might be close to ending. This may be your last chance to buy the dip (at least for a little while).

A Shameless Victory Lap

Yesterday, the Bureau of Economic Analysis (BEA), the U.S. agency tasked with tracking domestic economic activity, released their second estimate of Quarter 1 GDP.

You might remember that on April 5, Atlas Analytics predicted +0.6%. In contrast, the legacy forecasters of the New York Federal Reserve Bank predicted +2.6%, and the Atlanta Federal Reserve Bank predicted -2.7% approximately the day before.

Originally, the BEA released GDP on April 30 at -0.3%. They’ve since updated this number to -0.2%.

This means that Atlas Analytics was even closer than we originally thought, and it’s likely this number will be revised further with the final BEA release at the end of June.

To stay ahead of the curve and gain access to our exclusive real-time GDP and financial forecasts, consider subscribing to Atlas Analytics Premium.

Visit us at atlasanalytics.com for more information or reach out directly to discuss how we can help optimize your investment approach.