Mr. Market Comes Roaring Back. Did You Buy the Dip?

Atlas Analytics' Weekly Subscriber Update

This week, Mr. Market came roaring back. From last Friday’s close (April 18, 2025) to this Friday’s close (April 25, 2025), the DIA rose 2.5%, the SPY rose 4.6%, and the QQQ rose 6.4%. My favorite ETF, the XLK, which I’ve written about extensively for its cheap expense ratio, soared a whopping 8.1%.

Did you buy the dip like I told you?

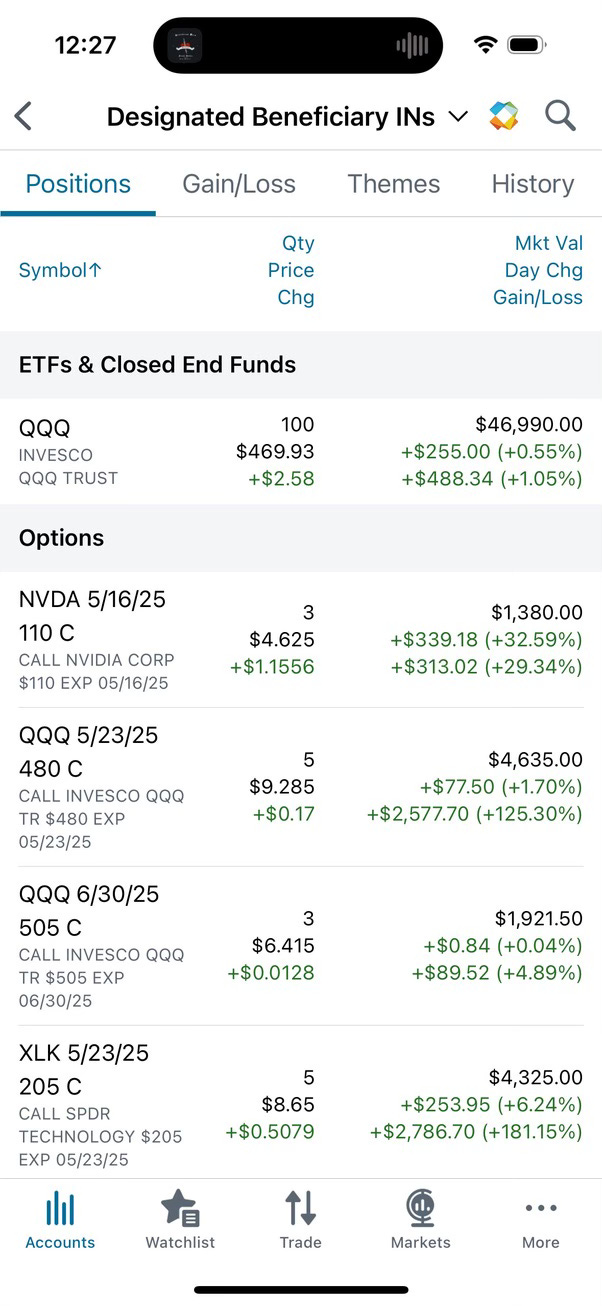

From my end, I continue to buy inexpensive call options (although, now they’re starting to become more expensive – more on this in a subsequent post) and offload my winners.

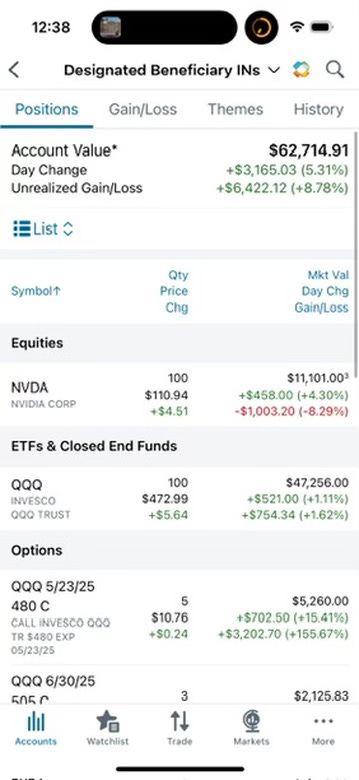

By selling my 3 long-call options on Nvidia (NVDA) just before close of business Friday, I earned 50% on this position alone. And, as I wrote two weeks ago, I continue to let my 480s on the QQQ and my 205s on the XLK ride (they still have a lot of extrinsic value as they expire in late May). (I also bought 3 long-calls on the QQQ at a strike price of 505 with a June 30 expiration.)

This brings my year to date (YTD) returns to nearly ~9%. Not bad considering the average weighted professional hedge fund returns for 2025 YTD was -0.94% according to Aurum.

So what is my investing strategy?