I Said to Buy the Dip…

Atlas Analytics' Weekly Subscriber Update

I hate to say “I told you so,” but in last week’s premium Substack article, in no uncertain terms, I wrote: “Buy the dip.” (I even put it in bold).

This week, the financial markets came roaring back with the second largest single daily gain on the NASDAQ since 1971. Even after some smaller declines on Thursday, the QQQ still finished the week up nearly 50 points!

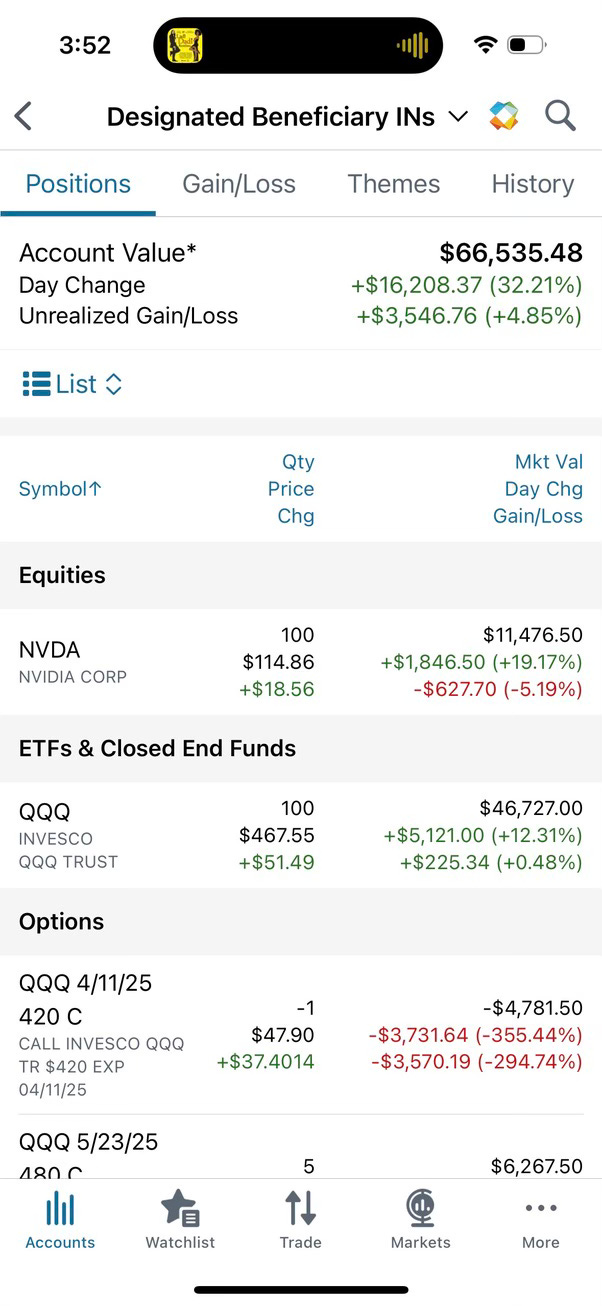

For those of us who positioned ourselves long, Wednesday’s gains were miraculous. Through a combination of buying NVIDIA on margin and loading up on cheap call options over the last month, I made my largest single day gain ever: $16 grand and a 32% increase in my portfolio.

To make back my initial investment, I sold my QQQ calls for the 455 strike, but I am letting my 480s on the QQQ and 205s on the XLK ride as I think we’re entering a new bull market (more on why in my next extended free post, the dramatic conclusion of my three-part series on the “Rubber Band” Theory of Finance).

So is the market rally over? And what should you do now?