The Tale of Two Prices: Fundamental Value vs Market Rate

Atlas Analytics' Weekly Subscriber Update

“It was the best of times, it was the worst of times, it was the age of wisdom, it was the age of foolishness…”

- Charles Dickens, A Tale of Two Cities (1859)

Dickens’ classic novel set during the time of the French Revolution famously juxtaposes life in London and Paris during a turbulent period.

So too do we live in turbulent times today. However, instead of juxtaposing life between two cities, two states, or two nations, Atlas Analytics’ analysis demonstrates the contrast between two prices: fundamental value vs. the market rate.

What is “Fundamental Value”?

Fundamental value is the intrinsic price an equity, asset, or the market is organically worth given underlying economic forces. It’s not sentiment, hype, or speculation. It’s the true value.

Previously unknowable, Atlas Analytics’ GDP forecasting technology allows us to predict the fundamental value of the financial markets using the historic relationship between economic activity and past values of the S&P 500, NASDAQ, and Dow Jones Industrial Average.

What is the “Market Rate”?

The market rate is the actual trading price of the asset, or what investors are willing to pay at any given moment. It reflects the sum of market sentiment, speculation, liquidity, momentum, and sometimes panic or exuberance. Unlike fundamental value, the market rate can swing wildly based on headlines, herd behavior, and short-term noise. While it determines profit or loss in real time, it doesn’t always reflect the underlying economic reality.

Why is Fundamental Value Different from Market Rate?

The title of this post as The Tale of Two Prices refers to the idea that for every asset, there are really two prices: the amount we pay and the amount we should pay. The market rate reflects emotion, momentum, and prevailing narratives; fundamental value reflects data, discipline, and underlying economic conditions. These two prices often diverge (sometimes subtly, sometimes dramatically) creating both risk and opportunity. Understanding the gap between them is essential for informed decision making, long-term investing, and macro-level forecasting.

How Does Atlas Analytics Calculate Fundamental Value?

In short: If you know where the economy is heading, you know where the stock market is heading.

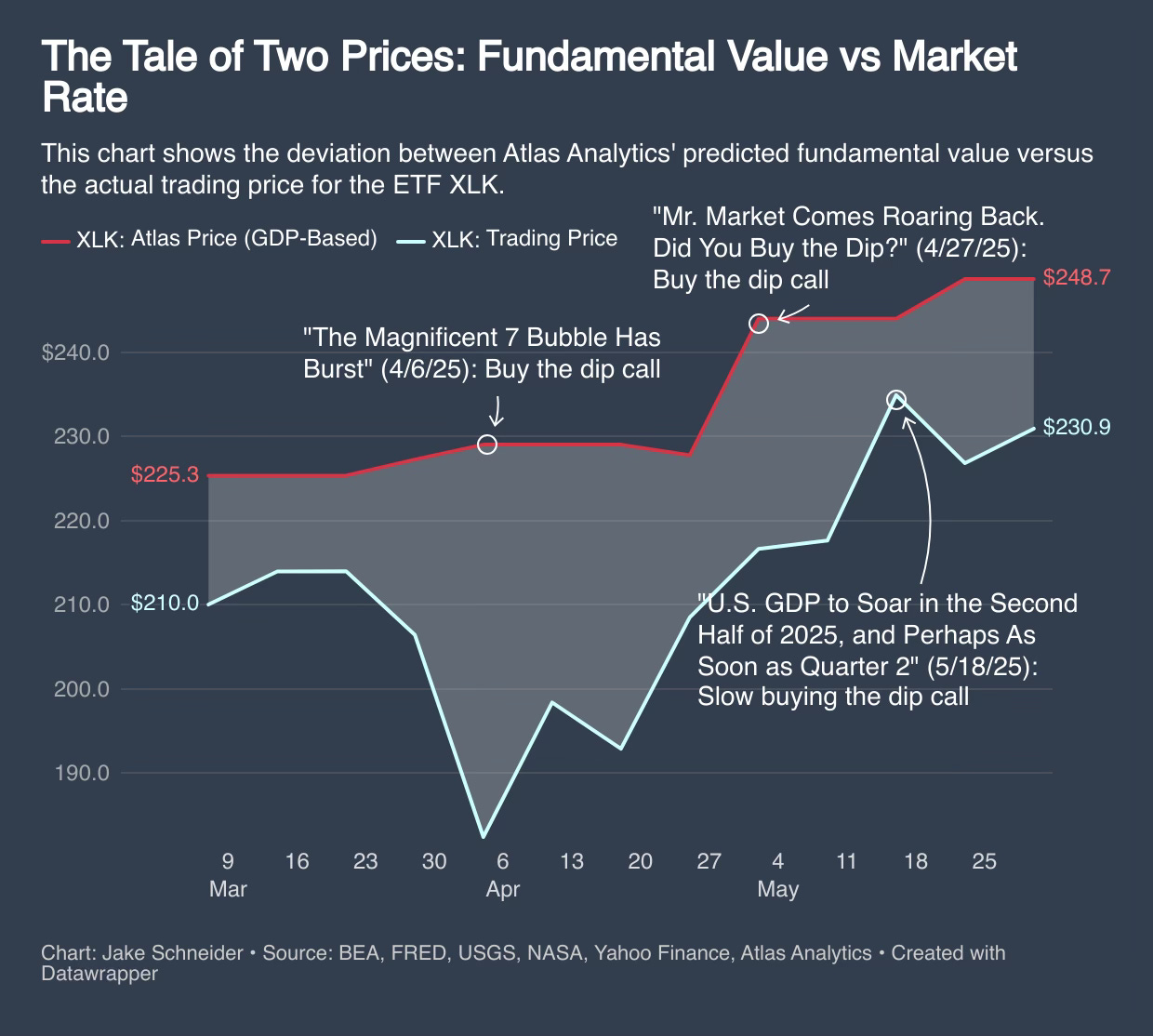

At Atlas Analytics, we use satellite data and other macroeconomic indicators to forecast U.S. GDP with unprecedented precision (see our post Atlas Analytics Predicts Q1 2025 More Accurately than the Federal Reserve). From there, we apply a series of regression models that relate historical GDP levels to past values of major equity indices like the S&P 500, NASDAQ, and sector ETFs such as XLK. These models allow us to estimate the fundamental value of financial markets based on projected economic performance, independent of short-term noise or sentiment. It’s a data-driven lens that helps investors see not just where prices are but where they should be.

Atlas Analytics Isn’t Just Accurate, It’s Actionable

As the chart above shows, Atlas Analytics has demonstrated exceptional accuracy in predicting market inflection points. On April 6th, our model signaled that the “Magnificent 7” bubble had burst, even as prices continued to fall, issuing a clear buy-the-dip call. Just three weeks later, while sentiment remained shaky, we issued a second call on April 27th, predicting the rebound that followed almost to the day. Our May 18th update anticipated accelerating GDP growth, justifying a continued but more measured approach to re-entering the market.

These aren’t backtested hypotheticals: these are real-time predictions made in advance based on our proprietary regression models that relate projected U.S. GDP to asset prices. With Atlas, you don’t just get insight; you get timing.

Want proof? All predictions are time-stamped on our Substack.

Want to trade with Atlas Analytics? Investors can subscribe to our forecasts or partner directly with us to access institutional-grade signals, alerts, and model-driven strategies. Whether you're managing your own portfolio or overseeing billions in capital, Atlas Analytics provides the signal clarity you need to outperform.

What’s Next for Atlas Analytics?

As Atlas Analytics continues to demonstrate accuracy and real-world value to investors, we're looking ahead to plans for continued growth and development. June 1 marks a significant milestone as I commit myself full time to building and guiding Atlas Analytics forward. Having ended my tenure as Senior Economist at the City of Boston this past week, I am looking forward to scaling Atlas Analytics’ impact and offerings moving forward. .

Finally, as I wrote three weeks ago in Sunday’s post, in partnership with New World Economics, Atlas Analytics is offering interactive corporate seminars to inform teams about economic activity, manufacturing conditions, and financial predictions. Interested? Inquire below.

As always, please reach out if you have any questions.

All my best,

Jake