Ad Astra per Aspera: Atlas’ Year in Review

Atlas Analytics’ Weekly Subscriber Update

TLDR: Atlas Analytics expanded our team, launched multiple pilot programs with institutional investors and family offices, delivered its strongest forecasting performance yet, and continued to prove that satellite-based, real-time macro forecasting is not just possible — but investable.

Ad Astra per Aspera — “to the stars through difficulty” — is a phrase born from exploration. Literally, it means rising upward through turbulence; contextually, it speaks to the work of pushing past old limits to see the world more clearly.

This captures the spirit of Atlas Analytics. By expanding the aperture of economic inquiry — looking not just at surveys or lagged releases, but at the Earth itself — we are proving that the path to better macro measurement runs through new perspectives. Satellite imagery, artificial intelligence, and machine learning give us a higher vantage point from which to understand the economy in real time. The journey is not without its challenges, but the destination is a clearer, faster, and more accurate understanding of economic activity.

And in 2025, that journey took a major leap forward.

With 2026 drawing near, Atlas is stepping into the new year with more momentum, clarity, and proof points. What began as a bold experiment in satellite-based macro forecasting in my early days working under the tutelage of Alan Greenspan has evolved into a validated, forecasting engine powering investment decisions, institutional pilots, and a growing team.

As this year comes to an end, we take a look back at Atlas’ key predictions, milestones, and what we have in store for 2026.

As Frank Sinatra said, the best is yet to come!

What We Achieved in 2025:

1. Atlas Leads, Government Data Confirms: Our Weekly Predictions Precede BEA Revisions with Accuracy and Alacrity

Atlas Analytics’ track record consistently shows a very strong correlation between our forecasts and the BEA final estimates.

Our year-in-review analysis reflects results through Q2 2025; Q3 will be discussed separately once revisions and component diagnostics are complete.

Despite the variability of the BEA releases and the longest U.S. government shutdown yet, ROY remained steady. ROY’s track record consistently shows an extremely strong correlation between our estimates and the BEA’s final estimates, released nearly three months later.

After the release of the BEA’s 2025 NIPA Annual Update, Atlas’ historical error rate tightened to 0.5 percentage points. Reaffirming that our independent, real-time signals anticipate the final picture long before it becomes “official”.

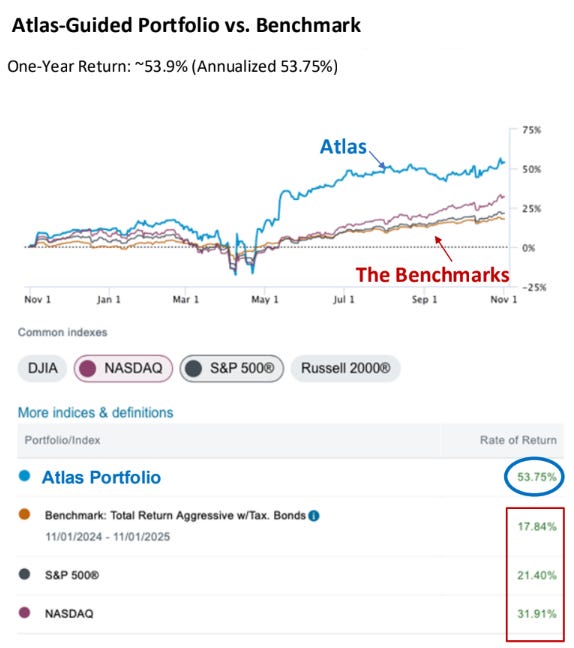

2. ROY Generated a 54% Annualized Return

Our macro-signal portfolio returned 54% over the past 12 months. That performance didn’t come from stock-picking. It came from reading the underlying economy in real time before the numbers were published, revised, and re-revised.

3. State-Level Forecasting Became a Core Atlas Product

We can now use ROY to evaluate predictive strength across all states for the past 15 quarters, showing where the model performs best and what these patterns reveal about the structure of the U.S. economy, including for Q3 2025 below:

This year we expanded beyond national GDP to produce state-by-state:

Forecasts and trend analysis

Correlation and cluster maps

RMSE accuracy scoring

These tools became increasingly essential for regional investors, supply-chain teams, and public-sector analysts navigating uneven economic conditions.

4. Pilots With Institutional Investors & Family Offices

In 2025, Atlas launched multiple pilot programs with institutional clients and family offices — many now integrating ROY directly into investment committee workflows.

5. Expanded Team → Expanded Capacity → Go to Market

Atlas grew from a solo project to a five-person team (including two advisors), increasing our ability to build, model, publish, and support client requests at a much faster cadence. We anticipate more than doubling our client capacity in the new year.

Looking Ahead to 2026

With data uncertainty likely to persist — from delayed releases to increasingly volatile revisions — the need for reliable, real-time forecasting has never been clearer.

Atlas enters 2026 with:

A validated forecasting engine

Strong financial performance

Active institutional and retail pilots

Expanding models across national, state, and sector levels

A growing team

Our mission is simple: Bring clarity to an economic system that increasingly lacks it.

We invite you to join us as we leverage our improved forecasting accuracy, expanding partnerships, and innovative solutions to meet evolving client needs. Whether you’re looking for data-driven insights or seeking a strategic partnership, we welcome the opportunity to collaborate with you.

Thank you for your readership and following along with us. Here’s to a very happy, healthy, and more data-stable 2026!

Till next year!

Ad astra per aspera,

Jake Schneider, Founder & CEO of Atlas Analytics

This article was written with valuable research assistance from Morgan Reppert, Executive Operations Associate for Atlas Analytics.