The Good, The Bad, and The Ugly, Part 3: Atlas Wins the GDP Corral Showdown

Atlas Analytics’ Weekly Subscriber Update

TLDR:

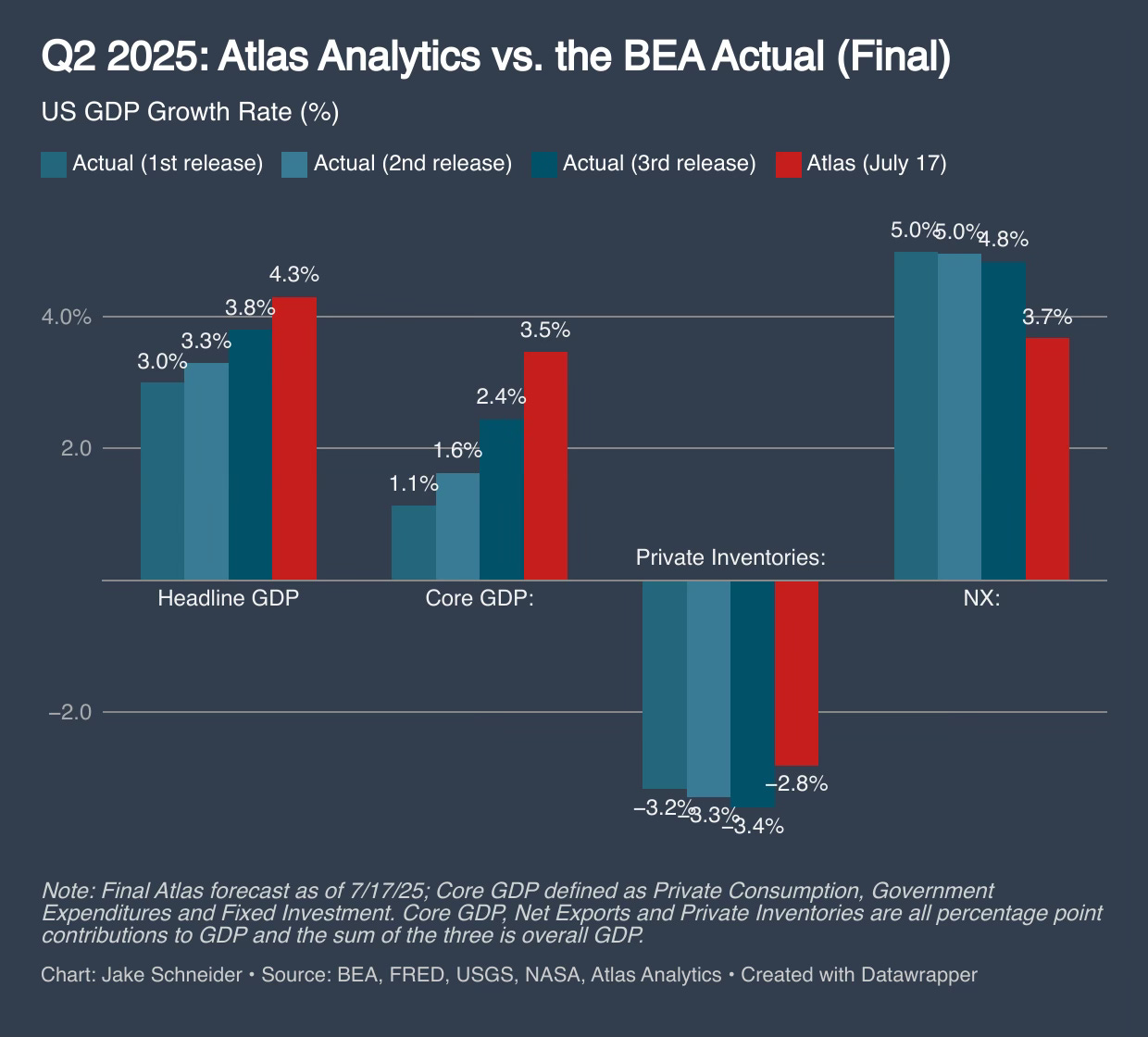

When the BEA first released Q2 GDP at +3.0%, most forecasters shrugged. We didn’t. On July 20, Atlas Analytics went on record calling for +4.3%, a full three months before the quarter’s final print.

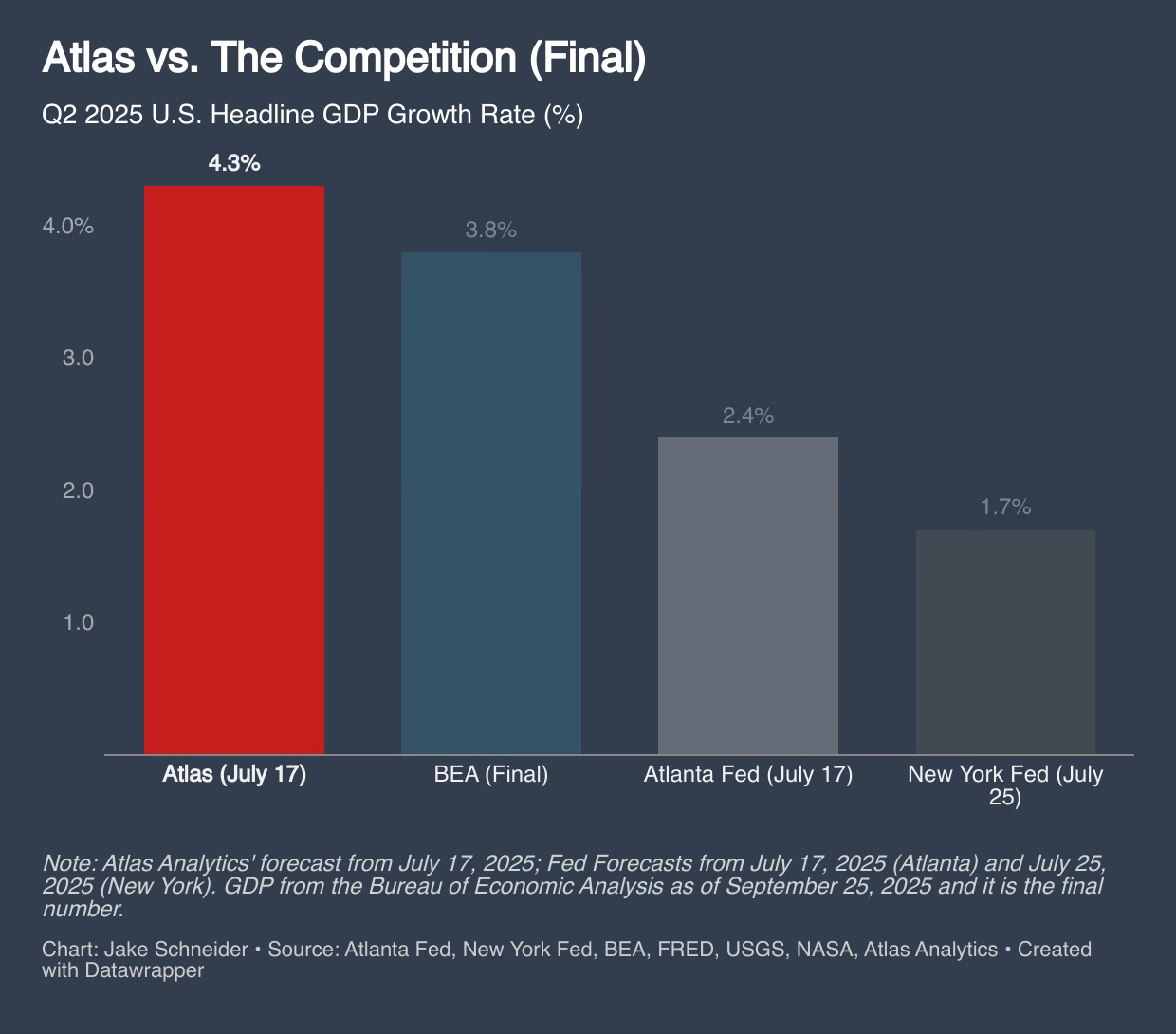

The Atlanta Fed was at +2.4%. The New York Fed at +1.7%. We stuck to our guns.

Last Thursday, the BEA issued its final number: +3.8%. Just 0.5 percentage points from our forecast.

We deliver these forecasts weekly to clients. If you’d like to see next quarter’s signals, let’s talk.

This story left off last month, when the Bureau of Economic Analysis (BEA) revised Q2 GDP to +3.3%, up from +3.0% first estimate.

Recall that Atlas Analytics predicted Q2 GDP would be +4.3%. We made this call on July 20 on our YouTube channel, far ahead of the Atlanta Fed (+2.4%) and the New York Fed (+1.7%).

After the BEA’s first revision, Atlas Analytics fired back, sticking to our guns that, even after the already sizable upward alteration, an even larger one was on the horizon.

A month elapsed. Tumbleweeds rustled by.

Then, last Thursday, the BEA released its final number for Q2 GDP on September 25, three months after the quarter had already ended: +3.8%.

Atlas Analytics missed by only 0.5 percentage points, we did it three months early, and we maintained our conviction even when the first release showed only +3.0%.

Remember when we threw down the gauntlet last month stating there was a “showdown at the GDP Corral” and that “this town was not big enough for the two of us [beating both private forecasters and Fed models in real time]”?

I’d say I’m safe in asserting that we not only held fast to our forecast, but we were also right.

If this latest revision and final number for Q2 isn’t vindication and a clear victory, I don’t know what is.

Satellite macroeconomic forecasting isn’t a Western-themed gimmick. It’s the real deal. Our clients know it, and so should you.

The Good

Frankly, this entire most recent GDP release was all good: headline GDP rose to +3.8%, driven primarily by Core GDP, which was revised up from +1.6% to +2.4%, and Net Exports (NX) was revised down to +4.8% (not far off from our estimate of +3.7%).

The Bad (But Still Good)

Even more compellingly, we vastly out-predicted our primary competitors: the Atlanta Federal Reserve Bank (+2.4%) and the New York Federal Reserve (+1.7%).

The New York Fed has now missed significantly in four consecutive quarters (including this one), underscoring why clients look at Atlas Analytics for satellite macroeconomic forecasting.

The Ugly

A small subnote on the Atlanta Fed’s GDPNow.

As we pointed out in my first The Good, The Bad and the Ugly article, they predicted +2.9% the day before the BEA released their first estimate of GDP.

At Atlas Analytics, we don’t view that as a true forecast so much as a near-term nowcast. Even with that timing advantage, Atlas Analytics still came closer to the final number (0.5 pp deviation vs 0.9 pp).

Showdown at the GDP Corral

There was a showdown at the GDP Corral. They (the Atlanta Fed) fired their shot. We at Atlas Analytics fired ours. We were the last forecaster standing.

Atlas has proven itself the most accurate real-time GDP forecaster this quarter and we’re just getting started.

Tracking GDP from the Stars to Your Portfolio

What does this mean?

For investors and clients: This kind of accuracy isn’t just academic. It’s alpha. A 0.8 percentage point upward revision in GDP shifted equity, bond, and FX markets in real time. Atlas Analytics clients saw it coming months in advance.

For angels: Momentum attracts momentum. We are proving satellite-based macro forecasting isn’t a parlor trick: it’s a commercial product. We’ve grown our team, expanded our client base, and are scaling quickly.

For VCs: GDP is just the start. The same AI + satellite pipeline that beat the Fed can nowcast trade balances, financial market targets, and global economic activity. We’re not just forecasting. We’re building the next generation of macroeconomic intelligence in a $30B alt-data market.

Atlas Analytics is becoming the gold standard for macroeconomic forecasting. And we’re just at the start.

For next steps, we’re:

Hiring for a Company Coordinator

Opening our Venture Capital round

Building our next algorithms

Expanding our reach to international markets

And seeking additional partners to pilot our data ahead of our official launch this fall.

Curious what’s cooking for Q3 and other macroeconomic indicators? Contact us.

Ultimately, we called it, we stuck to it, and we were right. That’s not bravado. That’s the beginning of a new standard for macroeconomic forecasting.