Trade Balance Reversal Signals Booming GDP Ahead

Atlas Analytics' Weekly Subscriber Update

Atlas Analytics boldly wrote that Quarter 2 GDP was set to soar on May 18, long before the rest of the market was aware of the changing tides of economic activity and trade.

Now that forecast is appearing prescient.

On Thursday, the U.S. Census Bureau released the Goods and Services Trade Balance for the month of April (our first look at Quarter 2 trade, and through our Atlas Analytics’ modeling, Net Exports).

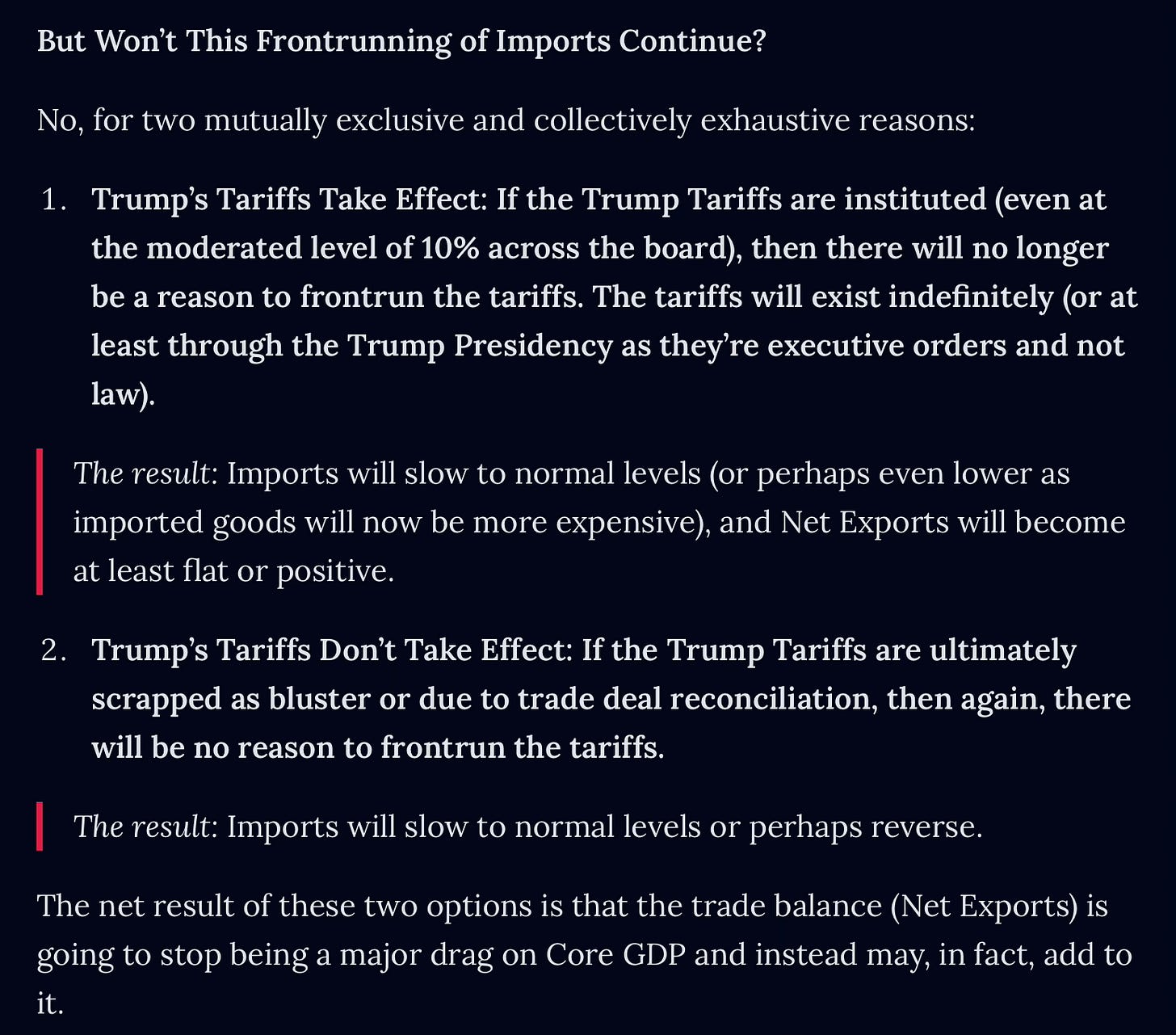

Recall, that Atlas Analytics has been consistently forecasting that the trade balance (and in particular imports) could not remain this out of equilibrium going forward for two reasons:

In short, we said that the frontrunning of the Trump Tariffs would end (sooner than later) and now the new Census data release confirms it.

As the chart at the start of this article shows, not only has April’s number reverted to the mean, it’s damn near broken through the trend and moved to levels above the normal trade deficit. We at Atlas Analytics are not suggesting the U.S. economy is heading for a trade surplus (we haven’t had one since the Greenspan years) but this does serve as a harbinger of something else: starkly positive GDP growth.

As we’ve been saying: We’re in a trade recession (not an actual one), and this trade recession is ending.

Prepare yourself for a boon in GDP growth in Quarter 2, and likely throughout 2025.

Don’t believe us?

Other economists and institutions are warming up to this fact too.

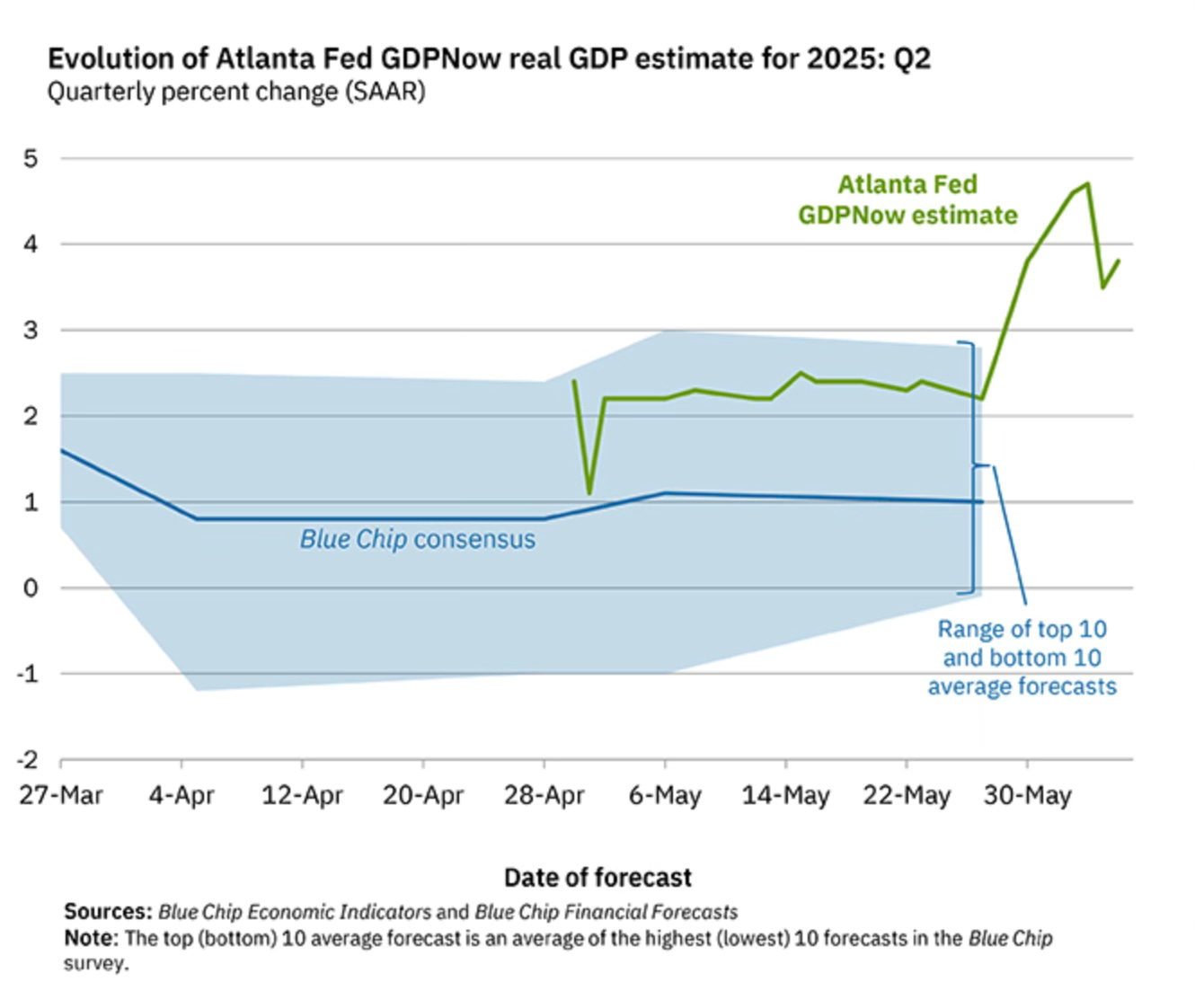

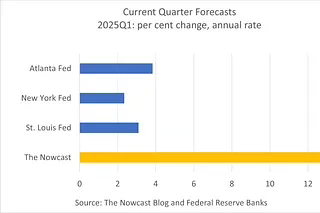

The Atlanta Federal Reserve’s GDPNow, a good tool although Atlas Analytics has been significantly outperforming its accuracy and timeliness for the past ~3 quarters, is now predicting 3.8% growth for Q2, down from 4.6% at the start of the week.

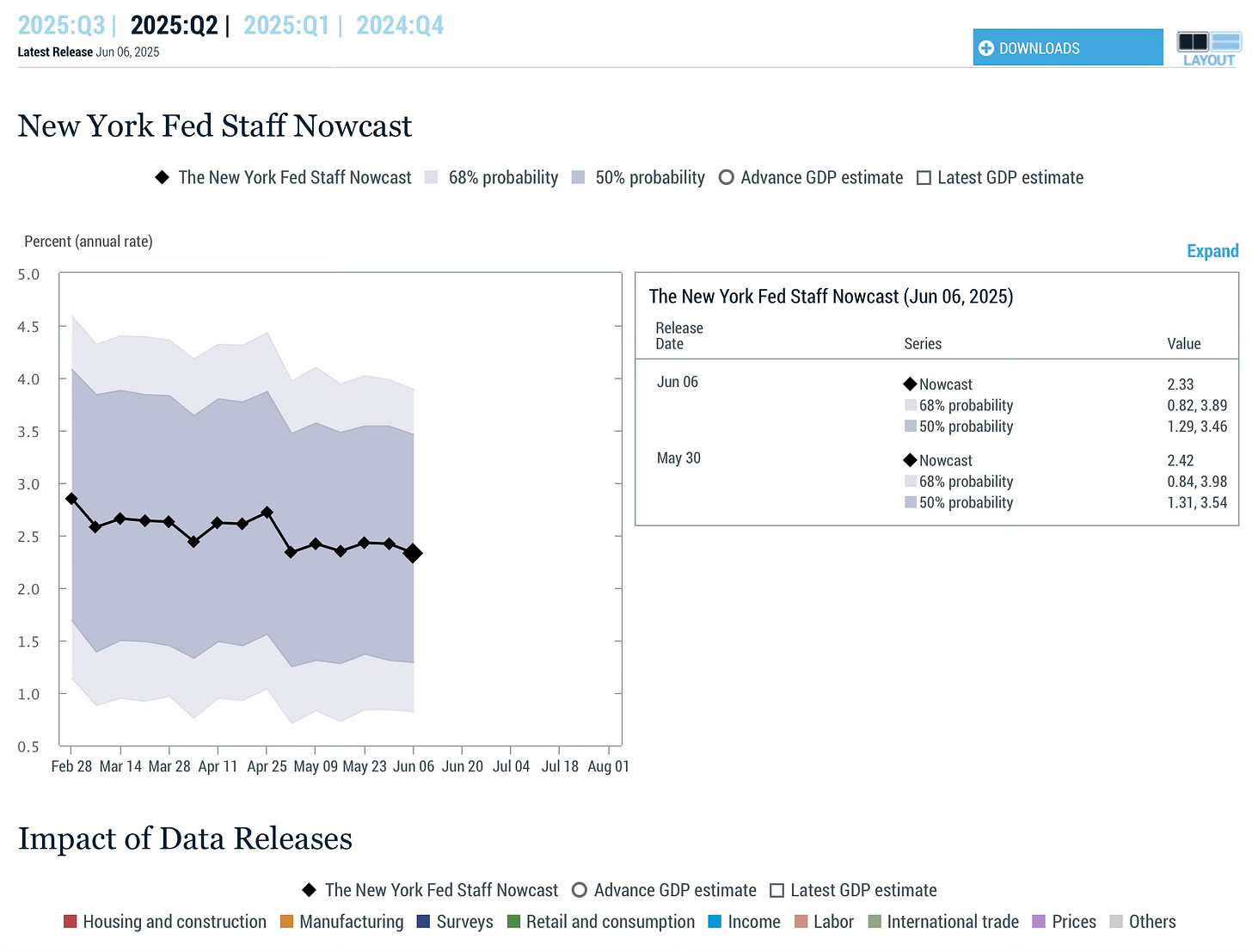

The New York Federal Reserve’s Nowcast is predictably sanguine, albeit positive economic growth, forecasting 2.33% as of Friday. As we’ve stated before, the NY Fed’s predictions have all been between 2% and 3% growth for the past 4 quarters, even though actual GDP during this period has ranged from -0.2% to 3.1%. We suspect their model is trained to simply “play it safe” by predicting long-term average US GDP growth (which averages about ~2.5% over the past 50 years) and, as such, we don’t put much “stock” (pun intended) in their predictions.

Interestingly, another private economic forecaster and friend of the company, Daniel Bachman has a more optimistic forecast. His model the NowCast, which we suggest following as well if of interest, has his most recent forecast at a whopping 12.7%. Now, Atlas Analytics is bullish, but we’re not quite that bullish.

So the consensus is moving towards our thinking that US GDP is on the rise.

What does Atlas Analytics think GDP will be and what should you do with your investments to prepare for it?

Atlas Analytics called it early. The market is just starting to catch up.

Now’s the time to act—not react.

If you’re managing capital, building portfolios, or advising clients, you can’t afford to ignore satellite-based macro intelligence that consistently beats the Fed, the street, and the cycle.

Subscribe to Atlas Analytics Premium for weekly GDP forecasts, sector insights, and investment signals grounded in real-time economic data—before it hits the headlines.

Outperform the consensus. Join Atlas.