Atlas Analytics’ Stock Portfolio Returned +53% Over the Past Year

How We Built Satellite Macroeconomic Forecasting to Achieve Excess Financial Returns

TLDR:

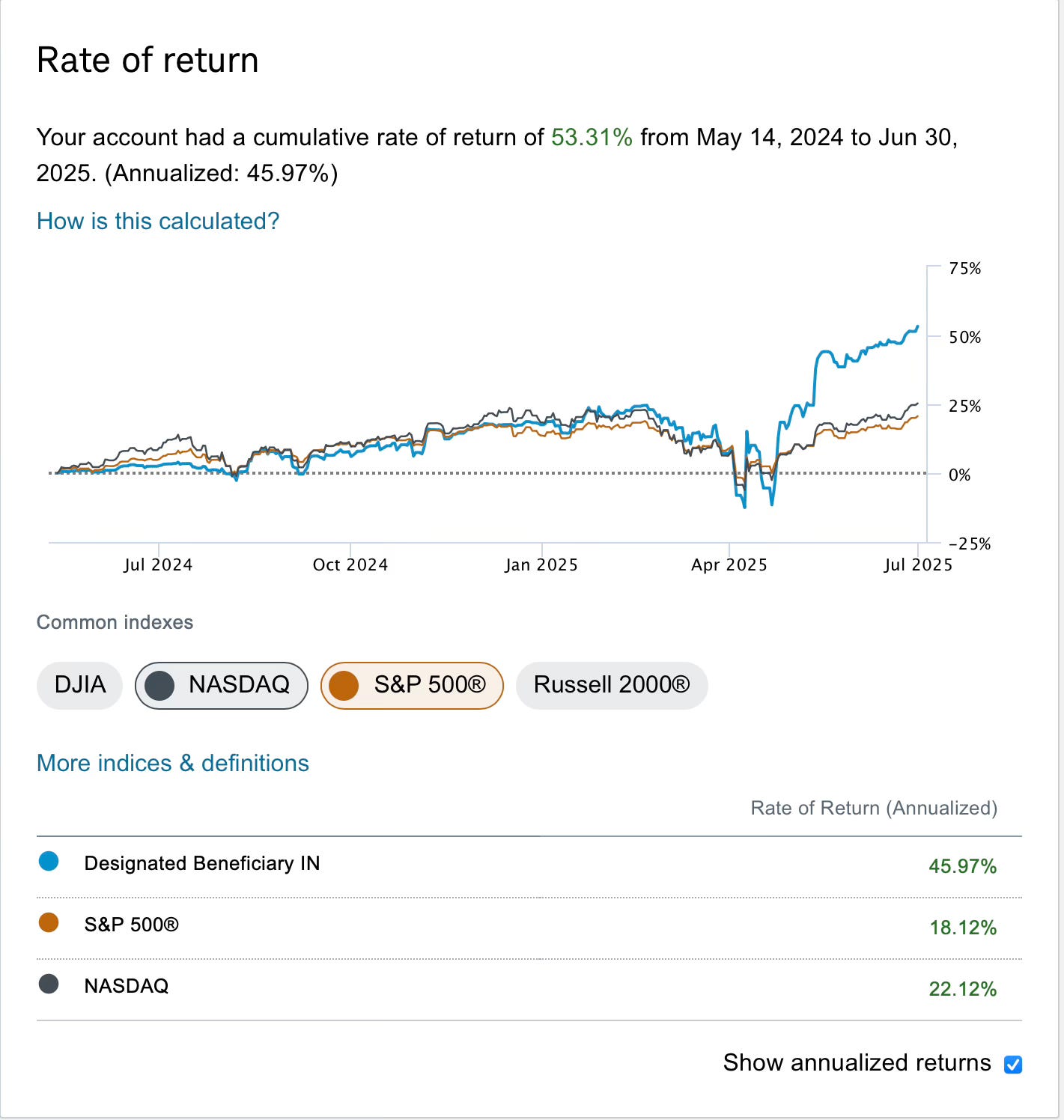

Atlas Analytics has returned +53.3% over the past 13.5 months, dramatically outperforming the S&P (+18.1%) and NASDAQ (+22.1%). We did it by building a new kind of macroeconomic forecasting system powered by satellite data, AI, and real-time geospatial analysis. Our core model, ROY (Remote Orbital Yield), beat both the New York Fed and Atlanta Fed in forecasting Q1 2025 GDP. We're not just predicting economic growth: we're turning that edge into real returns. This is the future of macro.

Now that the first half of 2025 is officially in the books, the Atlas Analytics team has taken account of our P&L and, for the first time, we’re sharing our results (bravely) with our subscribers and the investing public.

Over the past year and six weeks, Atlas Analytics’ stock portfolio is up +53.3% as documented by the above screenshot of our account with Schwab.

And at a +46.0% annualized return, our portfolio is vastly outperforming the benchmarks (the S&P is +18.1% and the NASDAQ is +22.1% during the same period).

How Atlas Analytics Was Born

In 2016, while working at Greenspan Associates, the private macroeconomic forecasting firm founded by former Federal Reserve Chairman Alan Greenspan, I came across an article in The Economist about hedge funds using satellite imagery to estimate Walmart sales by counting cars in parking lots.

It sparked a simple but powerful question:

“If we can use satellite images to forecast the sales of one company, why not use them to forecast GDP itself?”

That idea never left me.

When I began graduate work at the Harvard Kennedy School’s MPA/ID program, a curriculum modeled on the first year of a top economics PhD, I took every advanced course in AI, machine learning, and geospatial analysis I could find. I wanted to fuse economics with technology to build a real-time view of the economy.

By 2021, I had produced the first working prototype of what would become ROY (Remote Orbital Yield), Atlas Analytics’ main algorithm. I partnered with colleagues from Oxford, Harvard, and Georgia Tech to refine the model and test its predictive power in stealth mode between 2022 and 2024. After they exited the project, I formally incorporated Atlas Analytics in September 2024.

Atlas Analytics’ ROY Algorithm Doesn’t Just Work. It Outperforms.

Atlas Analytics’ ROY out-predicted the Federal Reserve by a wide margin for Q1 2025. In particular, the New York Fed predicted +2.6%, the Atlanta Fed’s GDPNow forecasted -2.7%, and Atlas Analytics estimated +0.6% (nearly a month before the others). Just last week, the Bureau of Economic Analysis released the final number at -0.5% (this after two estimates at -0.3% and -0.2%, respectively).

The Fed shifted their forecasts dramatically in the final weeks. ROY had it right a month ahead and never moved.

What’s more is that we’re using this tangible GDP accuracy to make better plays in the financial markets. Utilizing the insights, our Atlas Analytics portfolio is +53.3% since May 14, 2024.

What's Next

Today, ROY is generating real-time GDP estimates with proven accuracy, often beating the Fed’s own forecasts. But more than that, we’re building something bigger: a new lens for seeing economic activity as it unfolds globally and continuously. The future of macro isn’t monthly. It’s real-time, spatial, continuous, and Atlas is building it.